The Case for International Diversification: Why Your Portfolio Needs Exposure Beyond the Rupee

the best-performing assets globally. However, market dynamics shifted rapidly thereafter, with the

Indian market becoming an underperformer while global peers in the US, China, Germany, and

South Korea saw double-digit gains. While India remains a premier long-term growth story due to its

young population and fast-growing economy, this recent divergence serves as a stark reminder:

relying solely on domestic markets creates a concentration risk that can hinder long-term wealth

creation.Strategic international diversification is no longer just an “extra” for high-net-worth individuals; it is a

fundamental necessity for any resilient portfolio. Despite recent changes in taxation and regulatory

caps, the structural arguments for investing beyond the Rupee remain overwhelming.

1. The Global Opportunity Set

The most compelling argument for international investing is the sheer scale of the opportunity. As of

January 2026, the global equity market has expanded to a staggering $148 trillion, driven by

unprecedented growth in technology and innovation. In contrast, even as a top-performing emerging

market, the Indian equity market is valued at approximately $4.9 trillion to $5.3

trillion—representing just 3.5% to 4% of the world’s total market capitalization.

By confining an investment portfolio strictly to India, investors are effectively ignoring over 96% of

the world’s investment universe. To stay purely local is to miss the structural gains of the remaining

global giants that define the modern economy

This global universe offers access to world-class companies and dominant profit pools that simply do

not exist on Indian exchanges. For instance, “Magnificent 7” companies like Nvidia, Microsoft, Apple,

Alphabet, Tesla and Amazon are not just US stocks; they are global leaders shaping the future of

Artificial Intelligence (AI), semiconductors, cloud computing, and Electric Vehicles (EVs). Many of

these business models—such as advanced hardware manufacturing in Taiwan or South Korea and

massive digital consumer platforms in the US—are complimentary to the Indian market, which is

largely dominated by banks, energy, and traditional consumer companies.

2. Mitigating Geographic Concentration Risk

Even the strongest economy can face periods of stagnation due to domestic macro slowdowns,

political instability, or external shocks like oil price spikes, trade wars, or poor monsoons. When your

entire portfolio is tied to a single geography, a local crisis can devastate your savings.

Global diversification helps decouple your wealth from the specific cycles of the Indian economy.

Different markets have different “flavors” and economic drivers. For example, when Indian valuations

become expensive—as they did following the sharp rally ending in late 2024—having exposure to

markets like the US or Europe provides a necessary hedge. Experts generally suggest a strategic

allocation of 20% to 30% in global markets to maintain this balance.

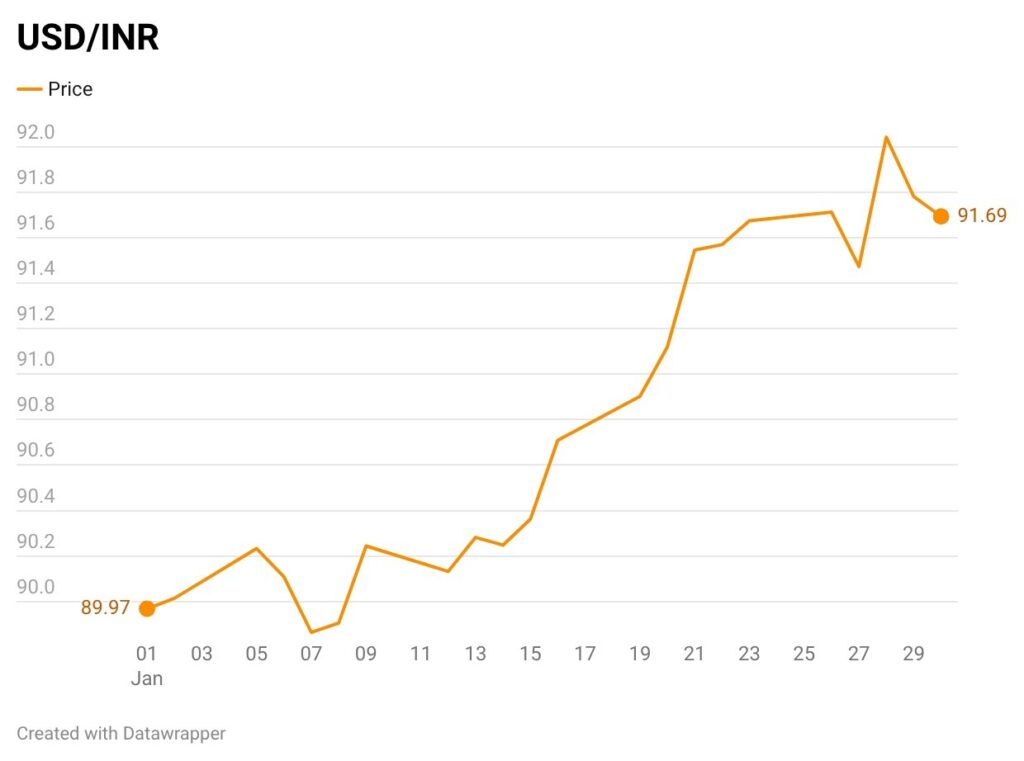

3. The “Added Charm” of Currency Depreciation

One of the most powerful tailwinds for Indian investors going global is the historical depreciation of

the Rupee (INR) against the US Dollar (USD). Over the long term, the interest rate differential and

trade deficits between India and the US have typically led the Rupee to weaken.

When you invest in dollar-denominated assets, your total return is the sum of the stock market

performance plus the currency appreciation. For example, if a US investment remains flat with 0%

returns over five years, but the Rupee depreciates from 80 to 100 per dollar in that same timeframe,

the Indian investor still realizes a 25% gain upon converting the funds back to Rupee. This is

particularly vital for families planning for future dollar-denominated expenses, such as a child’s

international higher education.

4. Navigating Investment Routes and the RBI Cap

Historically, Indian investors used domestic mutual funds to gain international exposure. However,

the Reserve Bank of India (RBI) has a $7 billion industry-wide limit on overseas investments for

mutual funds, which has been largely exhausted. This has forced many popular funds, such as the

Motilal Oswal Nasdaq 100 ETF or the Mirae Asset NYSE FANG+ ETF, to stop or restrict fresh inflows.

Currently, there are three main pathways to overcome these hurdles:

- Direct Stock Investing via LRS: Under the Liberalized Remittance Scheme (LRS), resident

Indians can remit up to $250,000 (approx. ₹2.2 crore) per financial year to buy international

stocks or ETFs. While this offers direct ownership, it requires active tracking and involves

currency conversion fees.

- GIFT City (IFSC) Funds: The emerging hub in Gujarat is a game-changer. Because Gift City is aregulatory offshore center located geographically in India, funds launched here do not fallunder the RBI’s $7 billion cap. New offerings, like the DSP Global Equity Fund, allow retailinvestors to access a diversified portfolio of 30–50 global stocks with a minimum investmentof $5,000 (approx. ₹4.5 lakh).● Existing Open Feeder Funds: A few domestic funds, such as the Edelweiss Europe DynamicEquity Offshore Fund, remain open for investment, though options are currently limitedcompared to previous years.

5. Demystifying Taxation: Diversification over Optimization

The complexity of taxation often scares investors away, but experts emphasize that the purpose of

global investing is diversification, not tax optimization.

The current tax structure for international assets is as follows:

- Direct Equity/GIFT City: If held for more than 24 months, gains are taxed as Long-Term

Capital Gains (LTCG) at 12.5%. If held for less than 24 months, gains are considered

short-term and taxed at your applicable income tax slab. - The TCS Factor: Under LRS, if you remit more than ₹10 lakh in a financial year, a 20% Tax

Collected at Source (TCS) is applied. However, this is not a final tax; it can be adjusted against

your total tax liability or claimed as a refund when filing your Income Tax Return (ITR). - GIFT City Innovations: Some structures in Gift City, like the DSP Global Equity Fund, are

designed to be even more investor-friendly. In this specific model, the fund pays taxes at the

fund level, meaning the investor’s individual gains can be tax-free, simplifying the reporting

process significantly.

Conclusion

While the Indian economy continues to be a “shining star,” the volatility of the last year underscores

the danger of a single-country portfolio. International diversification provides the dual benefit of

accessing innovation that is unavailable locally and providing a currency hedge against a

depreciating Rupee.

Despite the operational learning curve of new platforms like Gift City and the exhaustion of previous

mutual fund limits, the pathways to global markets remain open. By strategically allocating 20% to

25% of a portfolio to international assets, investors can ensure their wealth is not just growing with

India, but is also resilient enough to withstand local shocks while participating in the broader global

technological revolution. Don’t let tax complexity or short-term Indian outperformance deter you;

diversifying across borders is the key to building long-term, sustainable wealth.